Renters Insurance in and around Phoenix

Welcome, home & apartment renters of Phoenix!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Calling All Phoenix Renters!

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented space or property, renters insurance can be one of those most reasonable things you can do to protect your personal property, including your video games, silverware, microwave, guitar, and more.

Welcome, home & apartment renters of Phoenix!

Rent wisely with insurance from State Farm

Why Renters In Phoenix Choose State Farm

Renting a home is the right choice for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance may cover damage to the structure of your rented home, but that won't help you replace your possessions. Renters insurance helps safeguard your personal possessions in case of the unexpected.

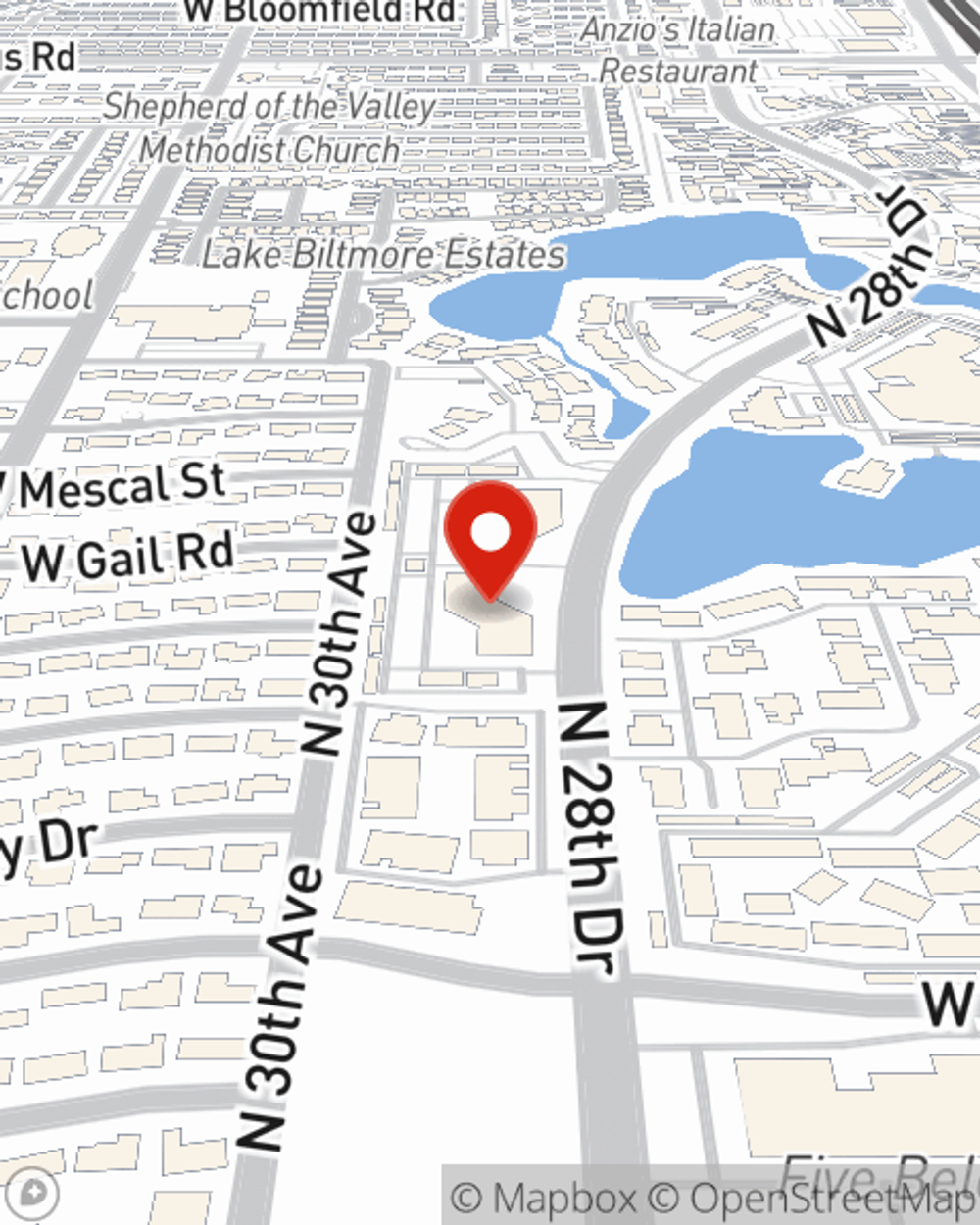

There's no better time than the present! Visit David Newland's office today to discuss your coverage options.

Have More Questions About Renters Insurance?

Call David at (602) 841-0505 or visit our FAQ page.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

David Newland

State Farm® Insurance AgentSimple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.